Financial Advisor Near Me - Truths

Wiki Article

Not known Factual Statements About Financial Advisor Meaning

Table of ContentsEverything about Financial Advisor JobsGetting The Financial Advisor Meaning To WorkSome Known Details About Financial Advisor Jobs Fascination About Financial Advisor Definition

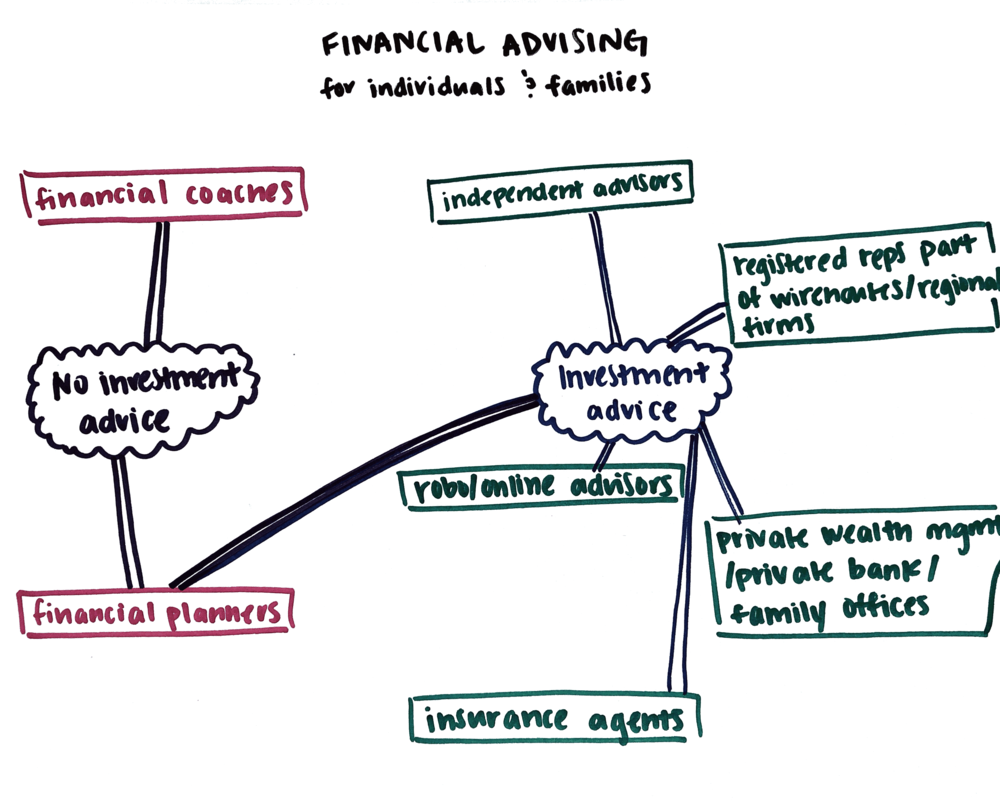

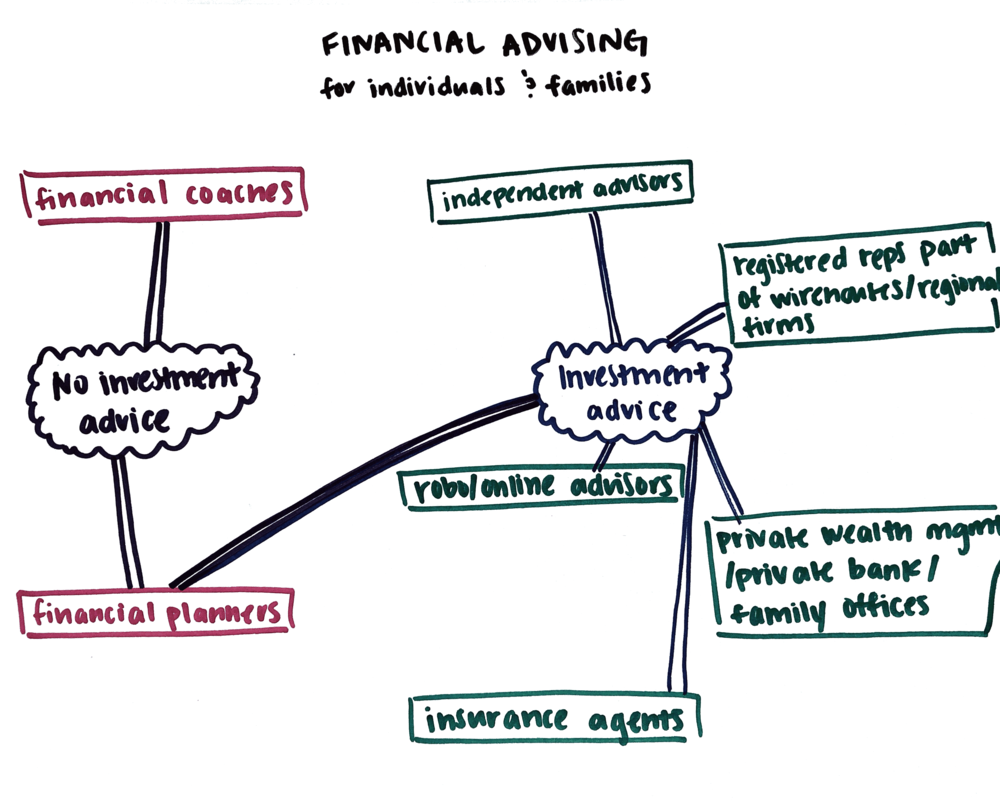

There are numerous sorts of economic consultants out there, each with varying qualifications, specializeds, and degrees of responsibility. And also when you get on the search for a professional matched to your requirements, it's not uncommon to ask, "How do I recognize which monetary consultant is best for me?" The response starts with an honest accountancy of your demands and also a little bit of research.That's why it's vital to research possible advisors as well as comprehend their certifications prior to you turn over your cash. Sorts Of Financial Advisors to Take Into Consideration Depending on your monetary needs, you might choose a generalised or specialized monetary consultant. Knowing your options is the primary step. As you start to dive into the globe of seeking a monetary consultant that fits your needs, you will likely exist with numerous titles leaving you questioning if you are calling the appropriate individual.

It is necessary to note that some economic experts likewise have broker licenses (meaning they can offer protections), however they are not entirely brokers. On the same note, brokers are not all qualified just as and are not monetary advisors. This is simply among the many factors it is best to begin with a qualified economic coordinator that can suggest you on your financial investments and retirement.

Some Of Financial Advisor Jobs

Unlike financial investment experts, brokers are not paid straight by customers, rather, they gain commissions for trading stocks as well as bonds, and also for offering shared funds and also various other products.

You can normally tell an expert's specialized from his or her economic accreditations. An accredited estate coordinator (AEP) is an expert that specializes in estate preparation. So when you're seeking a monetary consultant, it's good to have an idea what you desire assistance with. It's additionally worth stating monetary organizers. financial advisor license.

Similar to "economic advisor," "financial organizer" is additionally a wide term. Somebody with that said title can also have various other certifications or specializeds. No matter your certain demands as well as monetary circumstance, one standards you should highly think about is whether a potential expert is read this article a fiduciary. It may stun you to learn that not all monetary advisors are needed to act in their customers' best rate of interests.

Some Ideas on Financial Advisor Fees You Need To Know

To secure on your own from a person who is simply attempting to get more cash from you, it's a great idea to try to find a consultant who is signed up as a fiduciary. A monetary expert who is registered as a fiduciary is required, by regulation, to act in the finest interests of a client.Fiduciaries can only encourage you to make use of such items if they think it's in fact the most effective financial choice for you to this page do so. The United State Stocks as well as Exchange Payment (SEC) regulates fiduciaries. Fiduciaries who stop working to act in a client's finest interests can be struck with penalties and/or jail time of as much as 10 years.

That isn't because anybody can get them. Getting either accreditation calls for someone to experience a range of courses as well as tests, in addition to gaining a collection amount of hands-on experience. The result of the accreditation procedure is that CFPs and also Ch, FCs are well-versed in topics across the area of personal financing.

The fee can be 1. Costs normally decrease as AUM rises. The alternative is a fee-based expert.

The Facts About Advisor Financial Services Uncovered

For instance, an expert's management charge may or might not cover the prices connected with trading securities. Some consultants likewise charge a set charge per deal. Ensure you recognize any kind of as well as all of the fees an expert costs. You do not want to place every one of your cash under their control just to manage surprise surprises later on.

This is a service where the consultant will pack all account administration prices, including trading fees and also expense proportions, into one extensive cost. Due to the fact that this cost covers more, it is normally greater than a fee that only includes administration and excludes things like trading costs. Cover fees are appealing for their simplicity but additionally aren't worth the expense for everyone.

While financial advisor credentials a traditional consultant normally charges a cost in between 1% and also 2% of AUM, the charge for a robo-advisor is typically 0. The big compromise with a robo-advisor is that you typically don't have the capacity to speak with a human expert.

Report this wiki page